Silicon Valley Dreams, European Realities

What's the best place to build a startup? Discover why Europe's tech scene lags behind in innovation, as startups face bureaucratic hurdles, scarce venture capital, and a widening AI gap.

Hello, fellow tech enthusiasts and digital dreamers. Welcome to another eye-opening episode of Tech Trendsetters, where we rip off the rose-colored glasses and stare into the harsh reality of technology, business, and their often disappointing intersection. Today, we're diving headfirst into a topic I've always wanted to cover about the European tech scene: the slow, painful death of EU startups and the mass exodus of tech talent.

In this episode, we'll explore four crucial aspects of this complex issue:

The current state of European startups and venture funding

The challenges of running a global startup from the EU

The financial realities for developers in European tech hubs compared to other global centers

The emerging AI divide and its implications for European innovation

There are fewer and fewer startups focusing on the European market (even the UK) nowdays. Honestly, I don't even want to look at any facts about European startups because it just makes me too sad.

I've also long had the feeling that the European startup scene is on life support. While politicians and local accelerators keep peddling their feel-good stories about "innovation hubs" and "startup-friendly ecosystems," the numbers tell a different, far uglier tale. So, let’s unwrap it together.

The European Startup Ecosystem: A Bleak Reality

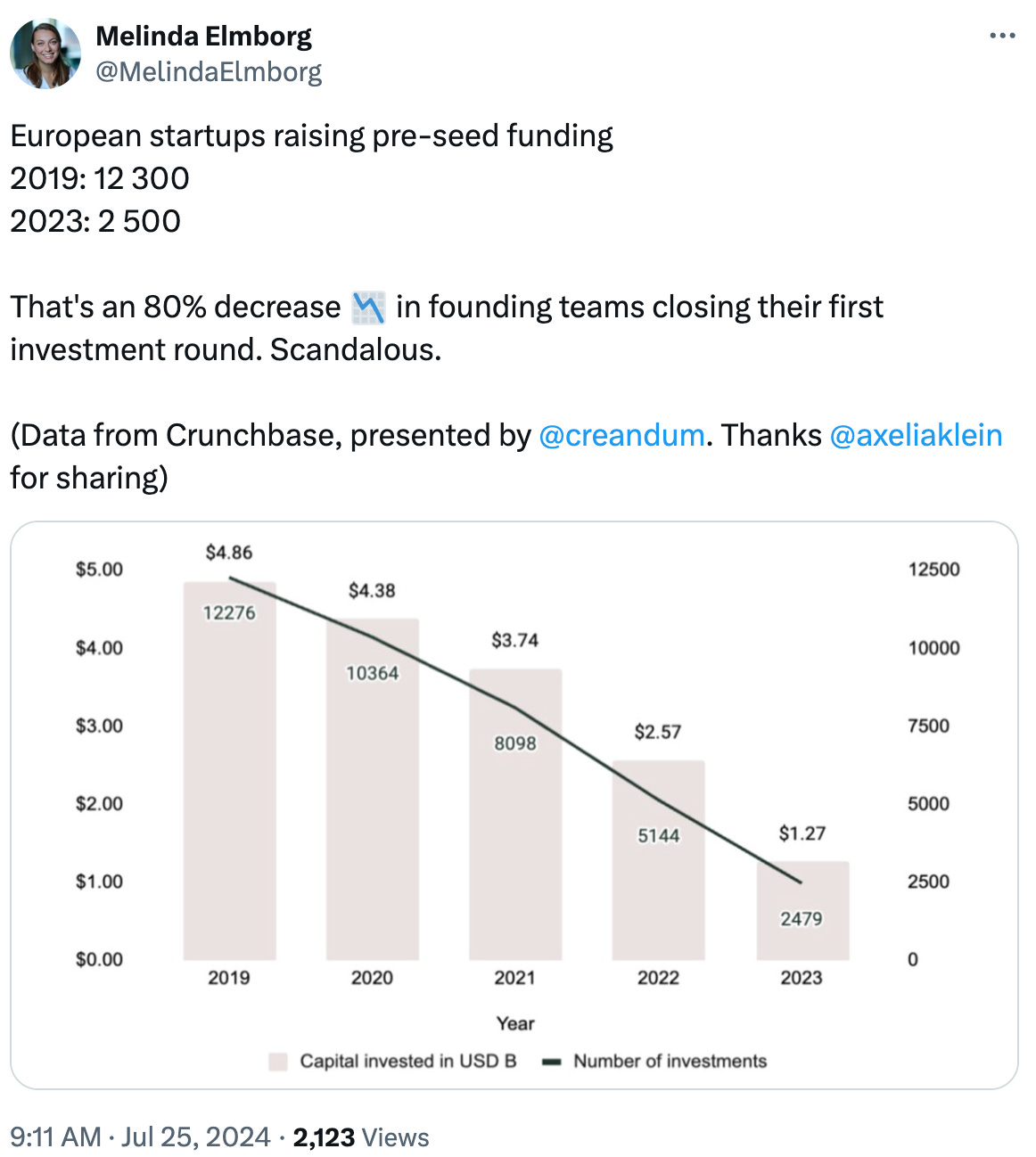

The graph above from Creandum based on Crunchbase data highlights the trend of venture rounds for early-stage startups (pre-seed) in the EU. We often hear about overall numbers, but these average figures don't mean much when they're driven by super-rounds for very large startups.

When it comes to early-stage startups, the situation is so bleak that it's hard to believe. The numbers for 2024 reflect the same trend. Of course, not everyone aims for venture capital, but such trends reflect the realities of the market: in Europe, there are almost no industries or problems that are so promising that venture investors are interested in them.

Many European VCs are looking beyond Europe: either investing in American startups or in European ones that are targeting more promising markets. For example, in Barcelona and Madrid, there are many startups focused on the growing Latin American market. However, it seems that if Spanish founders move to the US to work on the same startup targeting LatAm, their chances of success are much higher.

Much of the talk about good conditions for startups in the EU is just marketing, aimed at a domestic audience. Grants, tax incentives, startup visas, and accelerators are nice bonuses. But the only real source of growth is rapidly expanding industries. When there's a significant imbalance, startups come in to solve new business or user problems.

In Europe, it's easy and very pleasant to earn a modest income. You don't need to work excessively hard to lead a comfortable European life. But when it comes to making big money, achieving that in Europe is nearly impossible. Or by the way, if you wanted to become a millionaire working in a startup (even in an American one) – I have bad news for you:

Overall, starting a global startup in the EU is fine: it's a pleasant and understandable life, and you can comfortably develop your product. Just don't get your hopes up about significant local prospects – not in terms of market, venture capital, or startup incentives. For the most ambitious, it would be wiser to head either to the US or to rapidly growing markets!

There Are Always Better Jurisdictions

When we talk about growing markets and global startups, the overall business conditions are far more important than small startup programs. And in Europe, these conditions significantly lag behind other jurisdictions.

We often hear about new startup support programs in different EU countries. Compared to the past, these programs are indeed an improvement. However, startup visa programs are often just trendy add-ons to large immigration systems (especially true for Southern European countries). Similarly, startup support initiatives are minor, fashionable efforts within large corporate bureaucracies.

In the venture world, the "fabulous four" from Y Combinator is often the benchmark:

USA;

Canada;

Singapore;

and Cayman Islands.

These are the jurisdictions where YC itself is ready to invest in a startup. For a typical American VC or angel investor, Delaware C-corps are the most familiar.

The entire startup ecosystem is geared toward C-corps – from the ease of working with services to the clarity for contractors and accountants. When registering something different, every founder should have a clear answer to the question, "Why not a C-corp?" Often, the answer is due to extensive work with local contractors. But even in such cases, it might sometimes be wiser to operate through a place like Singapore with a convenient Stripe-like intermediary service.

If a founder is physically located in the EU, there are numerous additional complexities. CFC Rules, Capital Gains Tax, VAT, and more create significant hurdles.

German Founder's Case in Study

The complexities of starting a global startup from the EU are well illustrated by the experience of a German founder, Peer Richelsen. His story, detailed in an article titled "How I would start my next Startup in Germany without a GmbH", provides valuable insights into the pitfalls of the German startup ecosystem.

Richelsen's journey began in 2016 when he and his co-founder started a company as a UG, the simplest form of incorporation in Germany. However, they quickly encountered several challenges:

They made a key mistake by incorporating as private individuals rather than through personal holding companies, leading to unnecessary headaches and legal costs later. Seriously, who tells this to first-time founders? It's like government expects you to be born with an MBA and a law degree, just to be able to contribute to your own country’s economy.

They had to convert their UG into a full GmbH (the German equivalent of a limited liability company) once they generated €25,000, which required them to buy their own shares. Yes you’ve heard it right – you have to buy your own shares. Kafka would be proud of this bureaucratic masterpiece.

They accepted a priced round at a low valuation, unaware of alternatives like convertible notes. The lack of easily accessible information for founders in Europe is truly astounding. And I hope AI could fix that one day!

They faced numerous bureaucratic hurdles, including dealing with various institutions sending letters demanding fees and services. Most of such letters are fraud attempt, btw!

They encountered difficulties in setting up a bank account, a process that took up to 3-4 weeks. Because apparently, in the age of instant digital transactions, waiting a month to access your own money is completely reasonable.

The bottom line: Richelsen concludes that the GmbH structure is not suitable for startups aiming for global growth and recommends a different approach for future ventures. When they were accepted into Y Combinator, they finally had to flip their company into a Delaware C-Corp, which brings us back to a question: "Why not a C-corp?" Indeed, why go through all this bureaucratic nightmare when there's a simpler, more globally accepted alternative?

Now, it's worth noting that this is just one case study, and you could argue that these founders made multiple mistakes due to pure ignorance. However, this begs the question: why is the system so complex that even well-intentioned, motivated founders can stumble so easily? Shouldn't a startup-friendly ecosystem be more forgiving to newcomers and first-time entrepreneurs?

The Spanish Example

The challenges of running a startup in the EU extend far beyond just founding a company. In Spain for example, the process of investing in a company is another bureaucratic odyssey.

To invest in a Spanish startup, you need to obtain an NIE, which is a Spanish tax identification number for foreigners. Imagine this scenario: a eager Californian investor, excited about a promising Spanish startup, finds themselves standing in line at the Spanish consulate, filling out complex NIE forms, just to send a $10,000 check. It's not just time-consuming; it's a significant deterrent to foreign investment.

Now, contrast this with the investment process in the United States. Investing via a SAFE (Simple Agreement for Future Equity) in a U.S. company is breathtakingly simple in comparison. It takes literally minutes – sign a standard one-page document on a platform like Clerky, send the payment, and you're done. This streamlined process applies not just to small investments but also to amounts in the hundreds of thousands of dollars. The difference in efficiency is staggering and puts European startups at a significant disadvantage when competing for international capital.

Even Without Venture Goals

But the problems don't stop at investment. Even without venture capital goals, running a small global business from the EU is quite an adventure – and not always the fun kind. While the EU is undeniably a great place to live, with high quality of life and strong social safety nets, it's far from ideal for nurturing global businesses.

Many EU countries have launched trendy initiatives aimed at attracting startups and digital nomads. We've seen a proliferation of startup visas, tax incentives, and accelerator programs across the continent. While these are steps in the right direction, they're often just putting a band-aid on a broken leg. These initiatives, well-intentioned as they may be, are heavily constrained by the general bureaucratic rules of the entire Eurozone.

Take Germany’s freelancer visa as an example. While it exists on paper, obtaining one is notoriously difficult. The process is bogged down by inconsistent requirements, excessive bureaucracy, and regional differences that confuse applicants. The visa has one of the highest rejection rates, often citing vague reasons like “insufficient economic viability” or “unclear business plans,” making it incredibly challenging for even experienced professionals to navigate.

The fundamental issue is that the EU's regulatory framework wasn't designed with digital-first, globally-oriented startups in mind. It was built for a different era of business, and it's struggling to keep up with the pace of technological change and the needs of modern entrepreneurs. This mismatch creates friction at every turn, from hiring international talent to managing cross-border transactions.

This isn't to say that it's impossible to build a successful startup in Europe. Many have done it, and many will continue to do so. But it does mean that European entrepreneurs often have to work twice as hard, navigating a labyrinth of regulations and bureaucracy that their American or Asian counterparts simply don't have to deal with.

The Financial Realities for Software Engineers in Tech Hubs

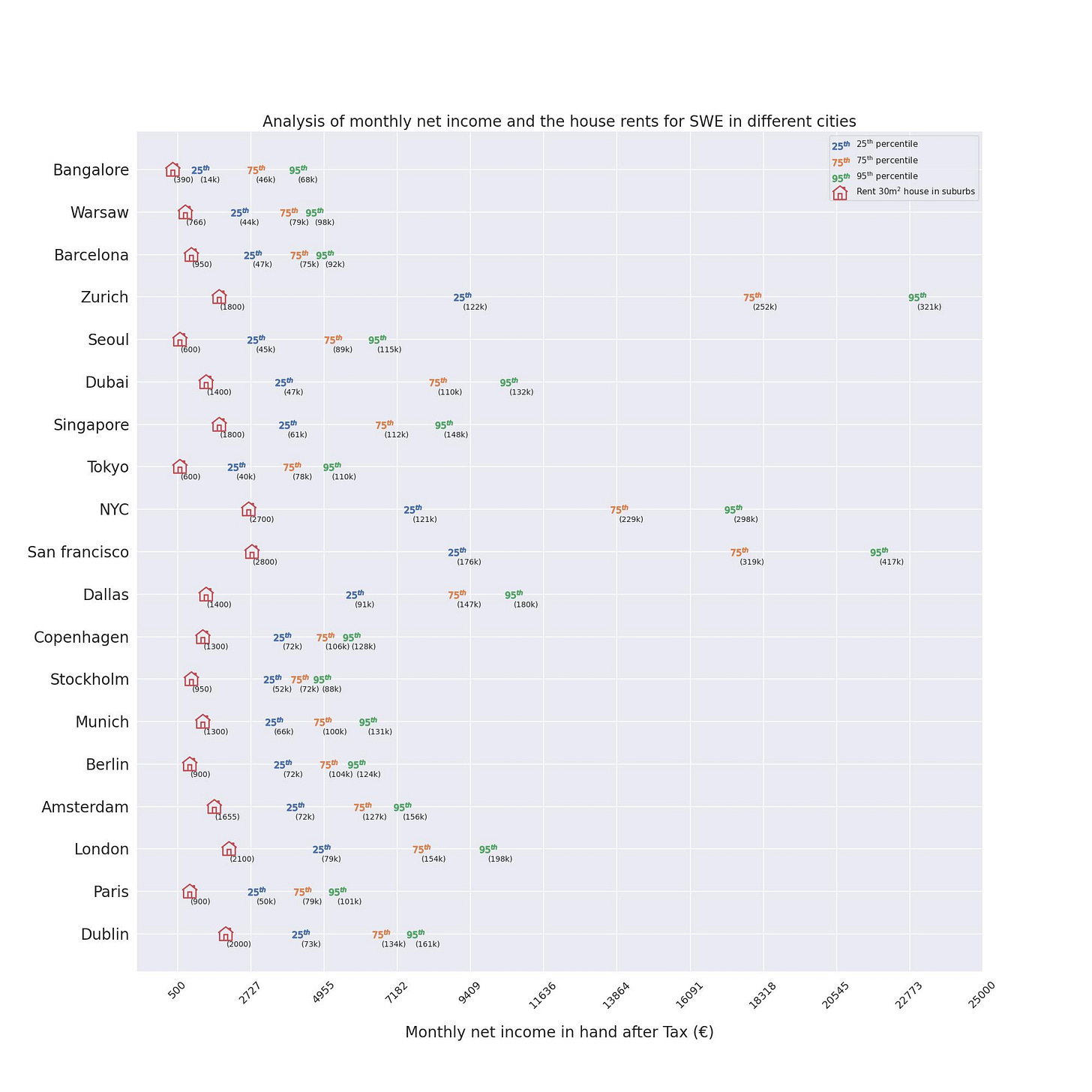

Someone on Reddit compiled data from levels.fyi on software engineer salaries in tech hubs after taxes, added the cost of modest housing from Numbeo, and accounted for the cost of living and rent index. This allows us to estimate how much developers can save in different cities.

The data nicely illustrate several points:

In the USA, salaries are incomparably higher than almost everywhere else. There are very few cities in Europe that come close. Well, yes, Switzerland, London, and Dublin's FAANG are exceptions.

For the most ambitious young engineers, there's no point in moving to the EU. In 5-10 years, less talented peers who moved to the US will be both wealthier and more in demand.

Quality of life in Western Europe is undoubtedly higher than in the US, but this is more true for those who earn less. Senior developers can afford a near-European standard of living in the US. And they still have more money left over from their salary!

"Europe is the new India for USA companies," noted someone on Reddit. This trend is becoming more apparent: European outsourcing is becoming more popular – you can draw your own conclusions.

As venture capital in the EU becomes more scarce, the gap in US salaries will widen further, leading to even more outsourcing from Europe to the US, and making freelancing from places like Serbia and Georgia more challenging.

Dubai, for developers, in terms of capital accumulation, is like a "fast-food version of the USA". Almost every developer in Dubai offices would likely accept an offer from New York. Importantly, the environment in Dubai doesn't help much with immersing oneself in the nuances of Western corporate culture. This means that places like Canada, Germany, or Finland, with lower salaries, might be more strategically sound (for outsourcing, not employees).

From the entire list of tech hubs, there's only one European city with a good climate. You can guess which one.

My favorite comment from the thread, was written by "SomeLateBloomer":

Can confirm. Moved from EU to USA. Quadrupled my salary. All the issues Europeans think Americans have do not apply to high earners like engineers. Healthcare? My hospital stay cost me $250. Safety? My building has its own 24/7 security. Schools? Who cares – by the time my kids will be ready for college I’ll be sitting on at least $5M conservatively, $8M realistically. And they still have the option of dual citizenship and studying in Europe as a backup plan.

Yes EU>USA for anyone in lower to upper middle class but holy crap if you’re an engineer and you have the option MOVE. Quality of life is great for engineers here: shit delivered to your doorstep at all hours; private pools; private gyms; giant SUV; freaking boat; it’s just such a practical country to live in.

In short, it's bleak for the EU.

European AI Realities

Remember one of the last episodes, when we talked about Meta's release of the new Llama model? If you're a loyal subscriber, you might recall my excitement about its potential to democratize AI development.

Well, hold onto your keyboards, because that excitement just got a cold shower of European reality.

It turns out that what's great for the global AI community isn't necessarily great for the EU. Why? Because Europe, in its infinite bureaucratic wisdom, has decided to be "special" when it comes to AI regulations. And by "special," I mean they're effectively building a digital Berlin Wall around their AI ecosystem.

AI Segregation: A New Reality for Europe

Meta recently announced that its new multimodal Llama model – capable of processing video, audio, images, and text – won't be released in the European Union. Here are the key points:

The company cited "regulatory issues" as the reason, specifically mentioning "the unpredictable nature of the European regulatory environment".

This decision means that European companies won't be able to use these multimodal models, despite them being released under an open license.

It's a vivid example of how regulatory differences are creating a divide in the global AI landscape.

Intriguingly, the United Kingdom has laws nearly identical to the EU's, yet Meta says it isn't facing the same level of regulatory uncertainty there and plans to launch its new model for U.K. users.

Apple's Bold Move: AI Features Withheld from EU

While Meta's decision was unexpected for many, Apple's recent announcement has sent even stronger shockwaves through the tech community and EU regulatory circles. Here's what's happening:

Apple declared not long ago that it would exclude EU countries from the roll-out of its new Apple Intelligence features, scheduled for launch in other parts of the world this fall.

Three key features won't be available to EU users:

iPhone Mirroring

SharePlay Screen Sharing enhancements

Apple Intelligence

Apple cited "regulatory uncertainties brought about by the Digital Markets Act" as the reason for this decision. In their own words: "Due to the regulatory uncertainties brought about by the Digital Markets Act, we do not believe that we will be able to roll out three of these [new] features [...] to our EU users this year."

Margrethe Vestager's interpretation (EU's vice-president): "I find that very interesting that they say we will now deploy AI where we're not obliged to enable competition. I think that is the most sort of stunning open declaration that they know 100% that this is another way of disabling competition where they have a stronghold already."

This situation even more highlights the growing tension between tech innovation and regulatory compliance in the EU. And we're not just talking about startups; even well-established corporations are giving up on entire markets.

The EU's AI Act: A Double-Edged Sword

At the heart of this issue is the EU's proposed AI Act. While it's dressed up as a noble effort to ensure ethical AI development, in reality, it's a bureaucratic nightmare that's more likely to stifle innovation than protect citizens. Let's break down this regulatory mess:

The EU loves nothing more than a good classification system, and they've outdone themselves this time. They've developed a "risk level system" for AI, complete with "clear obligations and transparency requirements" for high-risk systems. Sounds great on paper, right? But in practice, it means mandatory assessments of potential negative impacts on literally everything.

Not content with regulating existing AI, they've set their sights on "foundation models" too. Any model trained with at least 10^25 flops of computing power – think GPT-3.5 and above – falls under their regulatory gaze.

In a rare moment of sanity, Germany, France, and Italy managed to secure exemptions for open-source models. This gives some breathing room to companies like Mistral, Aleph Alpha, and even Meta with its Llama models. Thank goodness for Yann LeCun and his lobbying efforts, or we'd be in an even bigger mess.

Brace yourselves for the list of prohibited systems. It reads like a dystopian novel: no biometric categorization based on sensitive characteristics, no indiscriminate facial recognition databases, no emotion recognition in workplaces or schools, no social scoring, and no AI that manipulates human behavior. Noble intentions, perhaps, but it's a regulatory minefield that companies have limited time to navigate.

And if you thought that was bad, wait until you hear about the penalties. Non-compliance could cost companies up to 35 million euros or 7% of global turnover.

All of this bureaucratic red tape is going to increase operational costs, impose significant administrative burdens, and delay the time-to-market for new AI products in Europe.

Other countries will follow suit with their own laws, but those who don't tighten the noose too much on AI developers will come out ahead. British companies must be thrilled that they're not in the EU right now.

TLDR;

Well, today, we’ve covered some tough truths about the European tech scene. From the slow death of EU startups to the mass exodus of tech talent, and now the looming specter of AI segregation, it's clear that the Old Continent is facing a perfect storm of challenges.

Let's recap the grim picture:

European startups are gasping for air in a market that's increasingly hostile to innovation.

The labyrinth of European business regulations. It's a wonder any startups survive this regulatory gauntlet at all.

Europe is fast becoming the "new India" for U.S. companies – a source of cheap talent rather than a hub of innovation.

AI Apartheid created by EU regulators.

But what about the quality of life? The social safety policies? The work-life balance? These are common arguments who lives in EU. And yes, these are all valid points. Europe still offers a comfortable life for many. But comfort doesn't drive innovation. Comfort doesn't create the next world-changing startup. Comfort doesn't keep you at the cutting edge of AI development.

The harsh reality is that Europe is rapidly becoming a technological also-ran in a world where AI and innovation are the new global currencies. The continent that gave us the Renaissance, the Industrial Revolution, and countless scientific breakthroughs is now at risk of being left behind in the digital age.

But here's the million-euro question: Is this the end of the story for European tech? Or is there a plot twist coming? You'll probably find out in the next episodes! Until next time!

🔎 Explore more: